Pop the Champagne! 2018 was a banner year at the world headquarters of Meldel…wait….I owe HOW MUCH in taxes!? Better make that a cheap Prosecco.

As I near my 10-year freelance anniversary, I zoom in to take a closer look at my financial picture including insurance, taxes, income, investments and expenses. My total income begs the question, where does my money go!?!? I’m still happily rocking thrift store clothes, taking the bus, and always scouring free boxes for treasures. My husband and I even vacation on the cheap with our discovery of the Home Exchange network. We live comfortably in our North Portland bungalow, and have enough money for restaurant meals, a Netflix subscription, organic food and the occasional getaway. We’re not in debt, but also not saving enough. We're knee deep in middle-classdom, just keeping pace with our growing expenses and cost of living. I ambition to a be a super savvy, bad-ass boss babe. In actuality, I still have a lot to learn in the realm of financial planning, investing, and prepping for tax season. This report is an effort to wrap my arms around some of these topics.

Let’s dive into the details.

Income

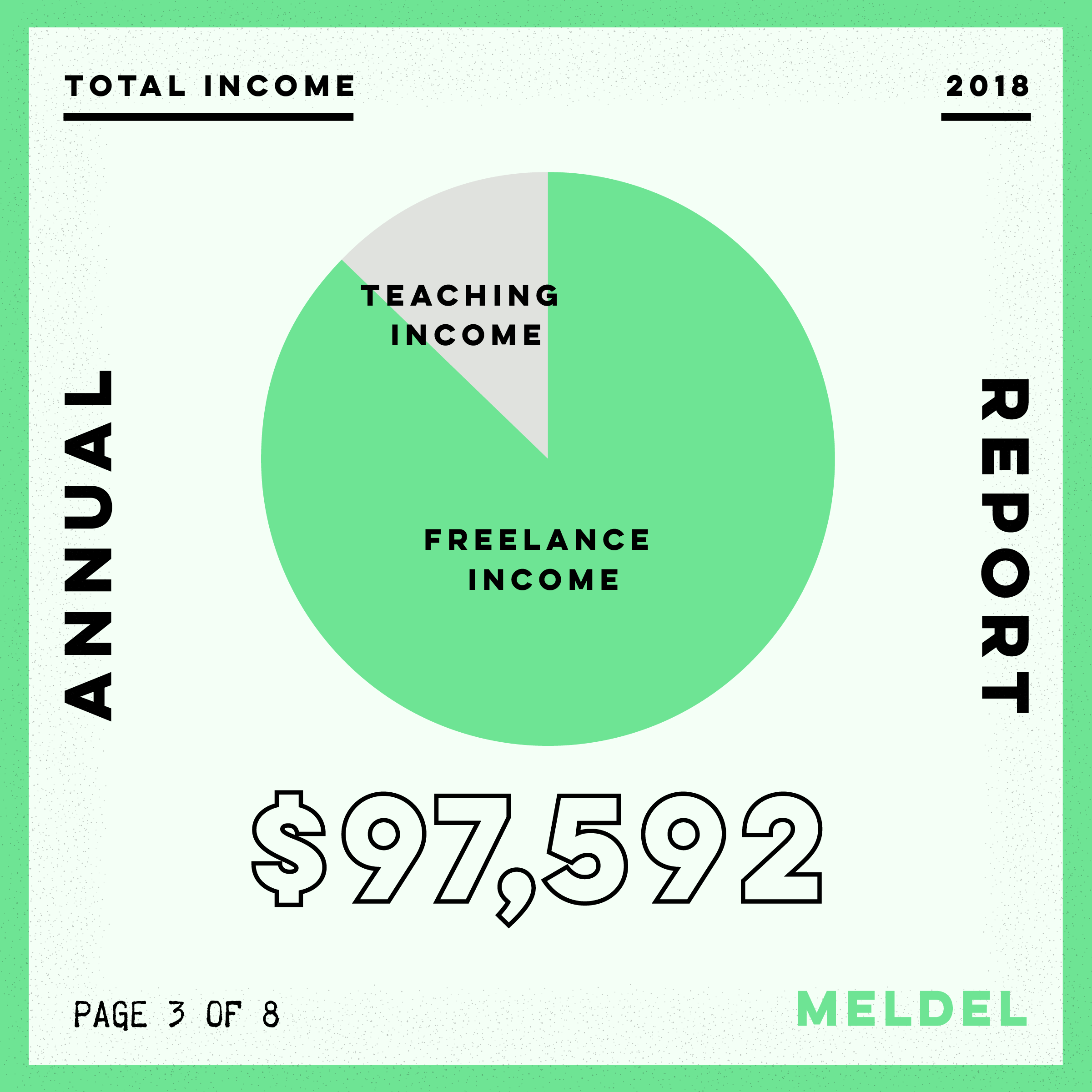

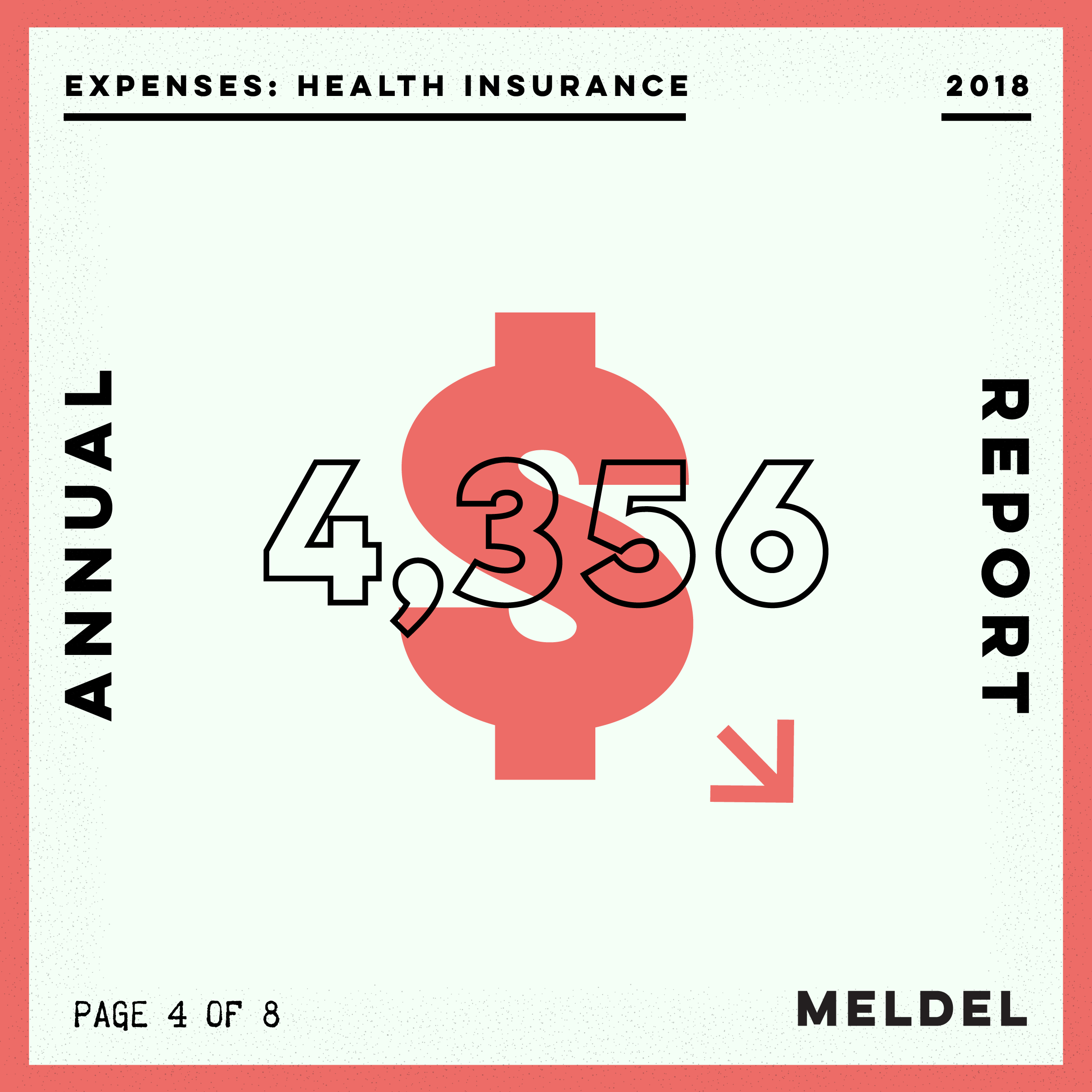

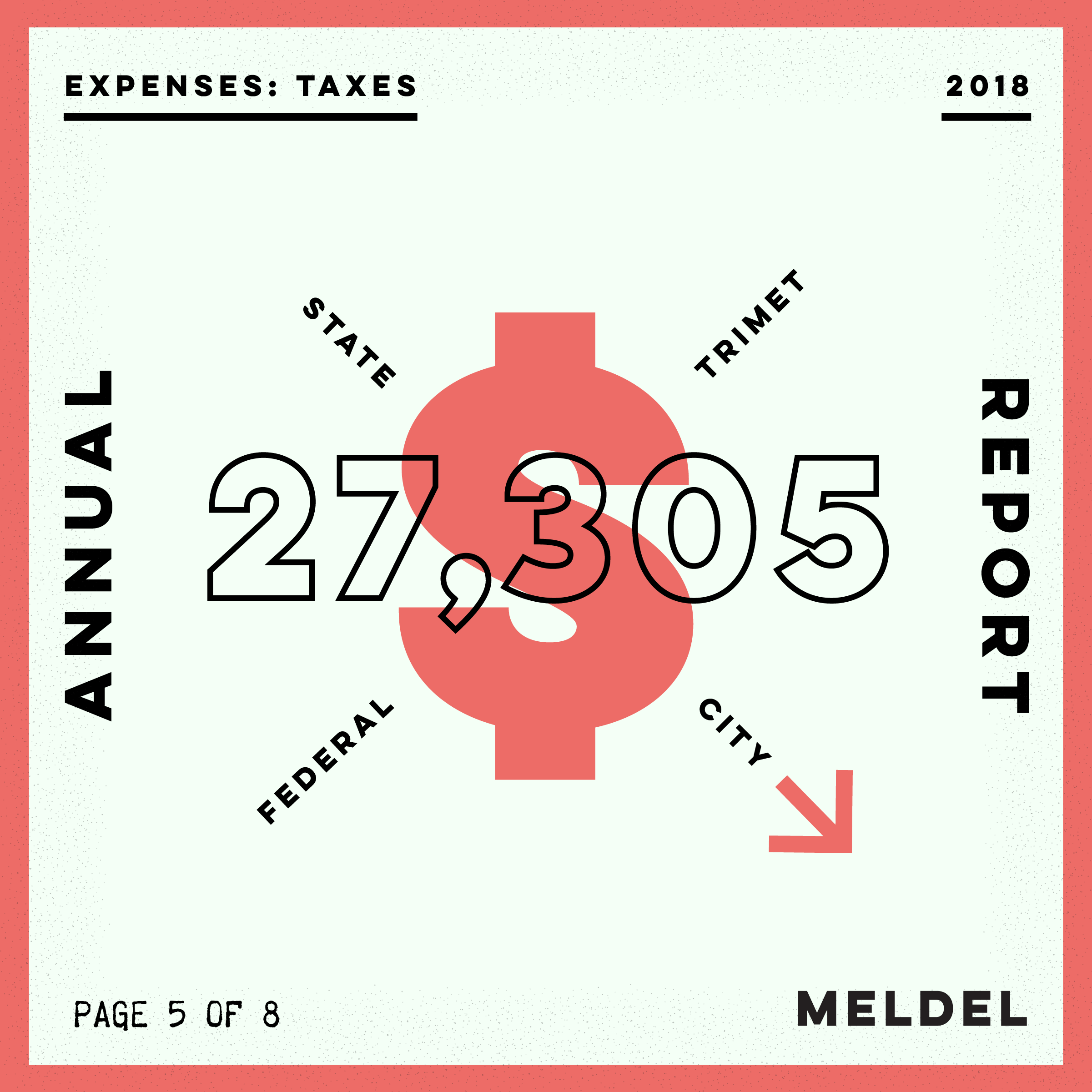

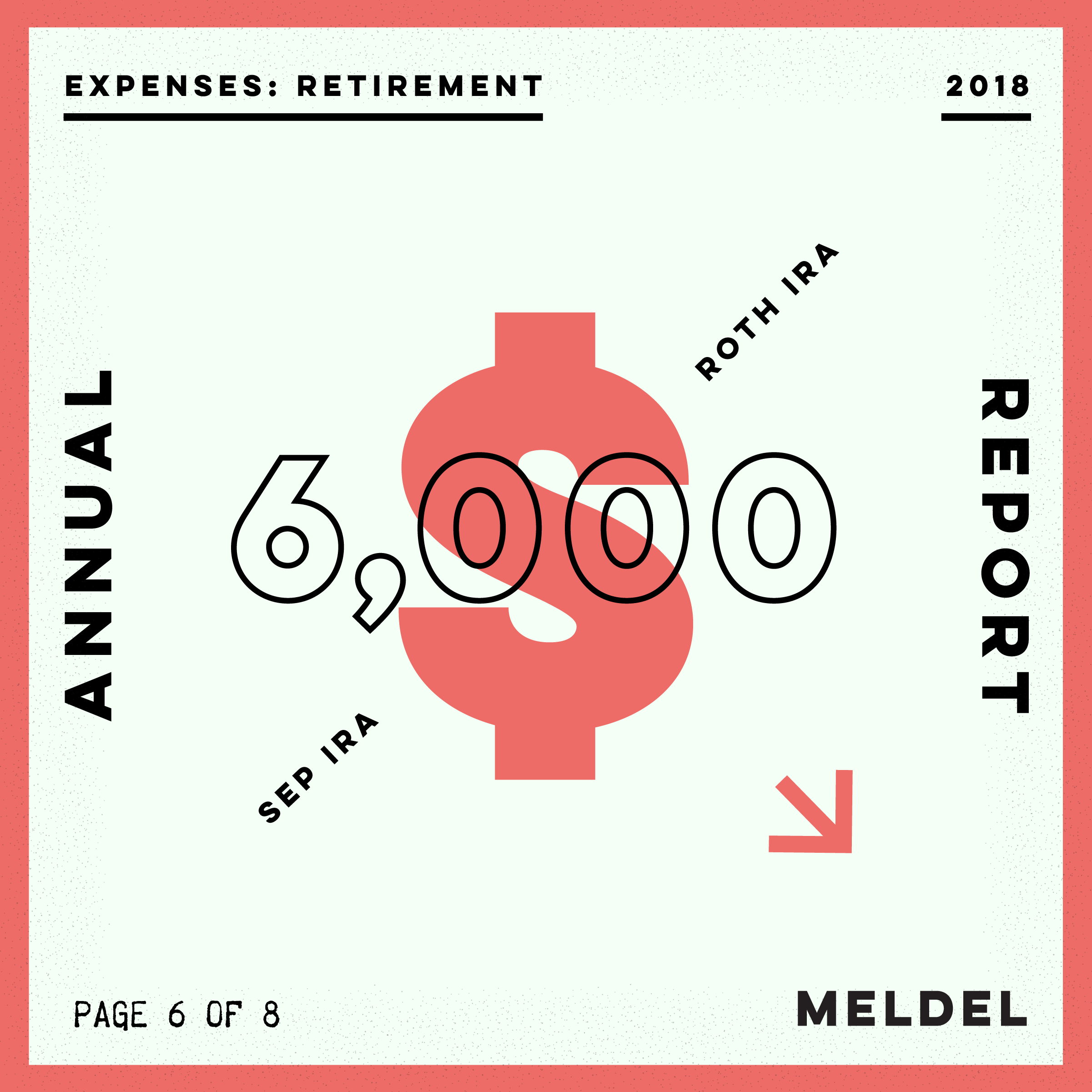

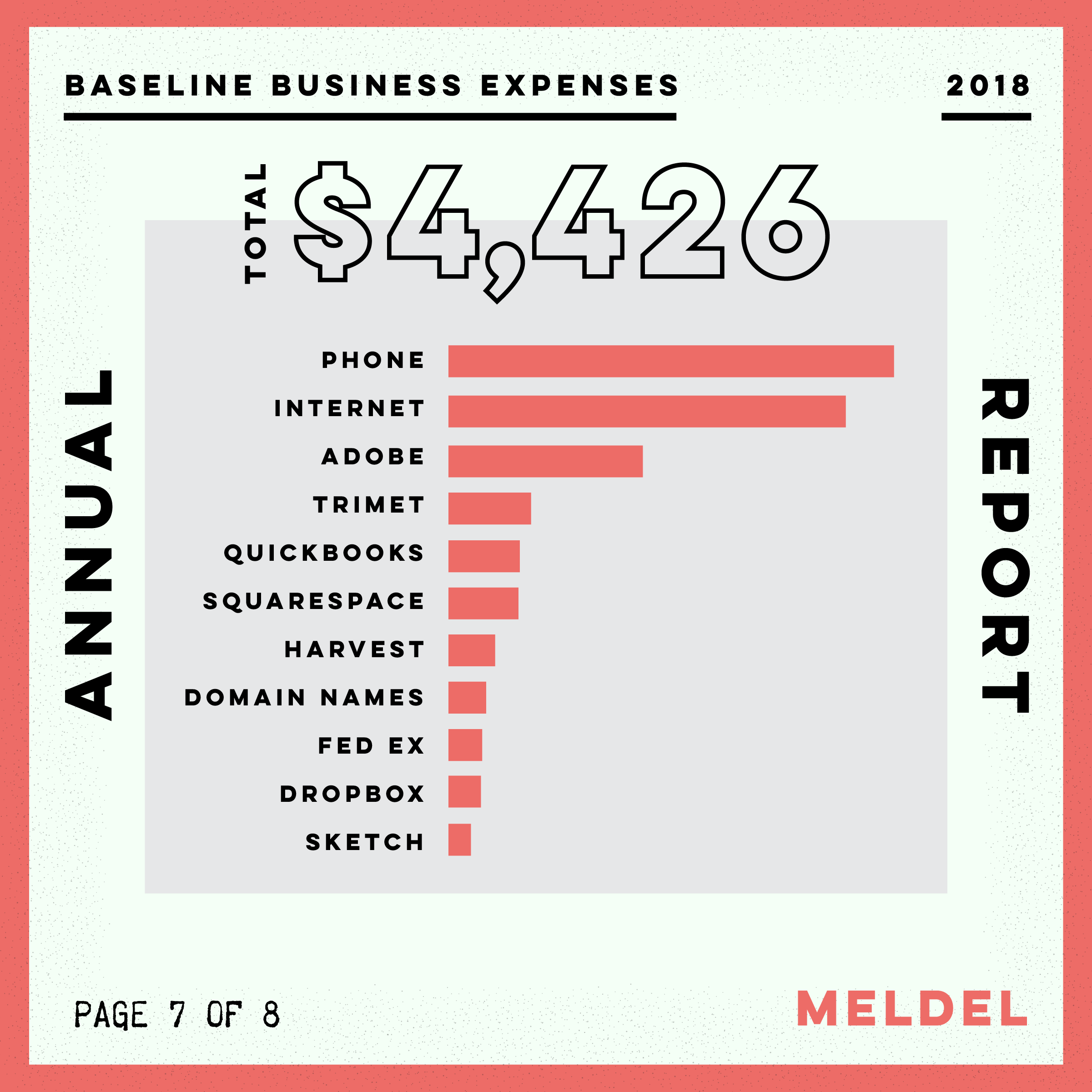

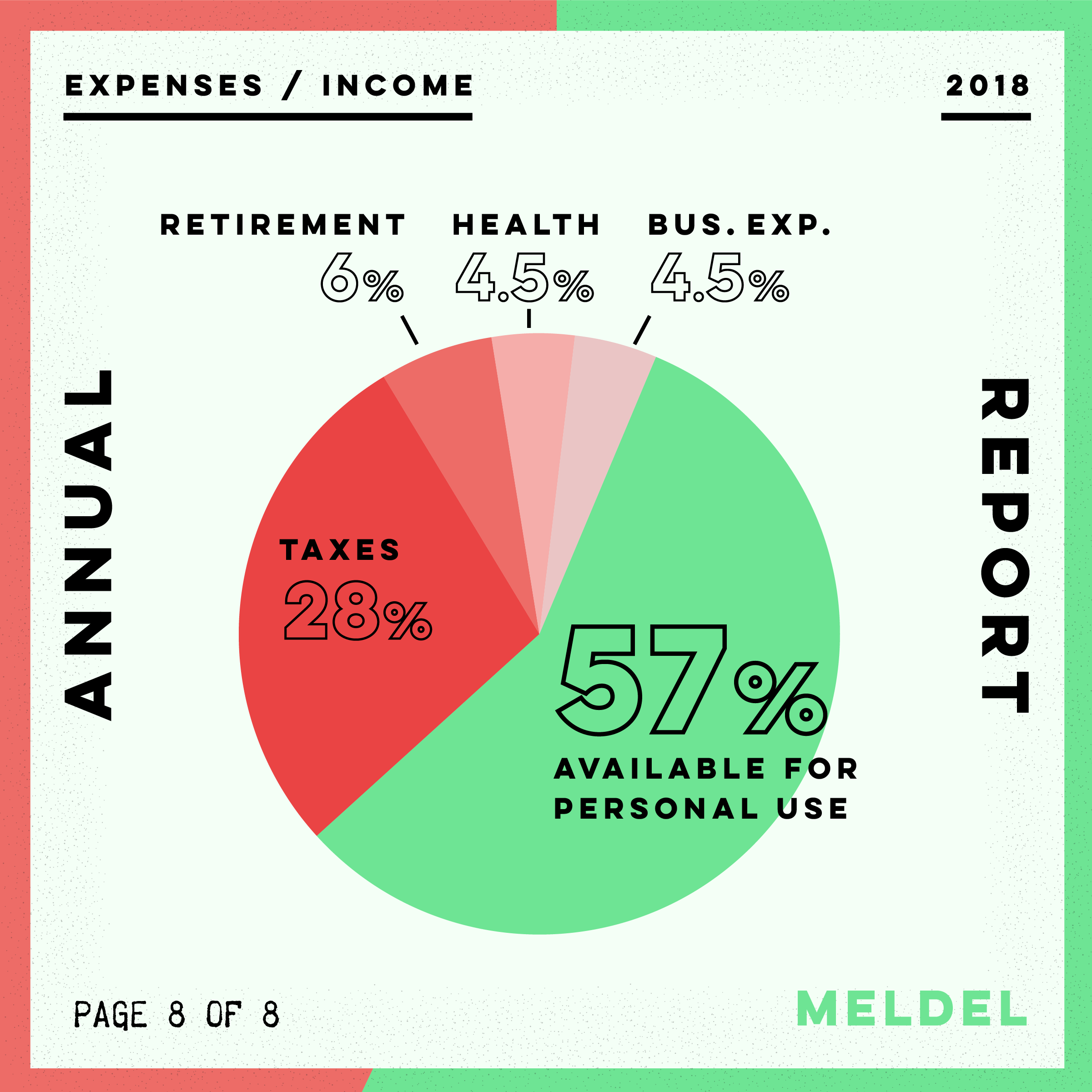

In short, I found that taxes, health insurance, retirement savings and standard business expenses wipe out about 43% of my income. The remaining 57% is not necessarily fun money, it (along with my husband’s income) goes toward all the daily living expenses: mortgage, property taxes, utilities, food, dog expenses, gym memberships, health expenses and home repair.

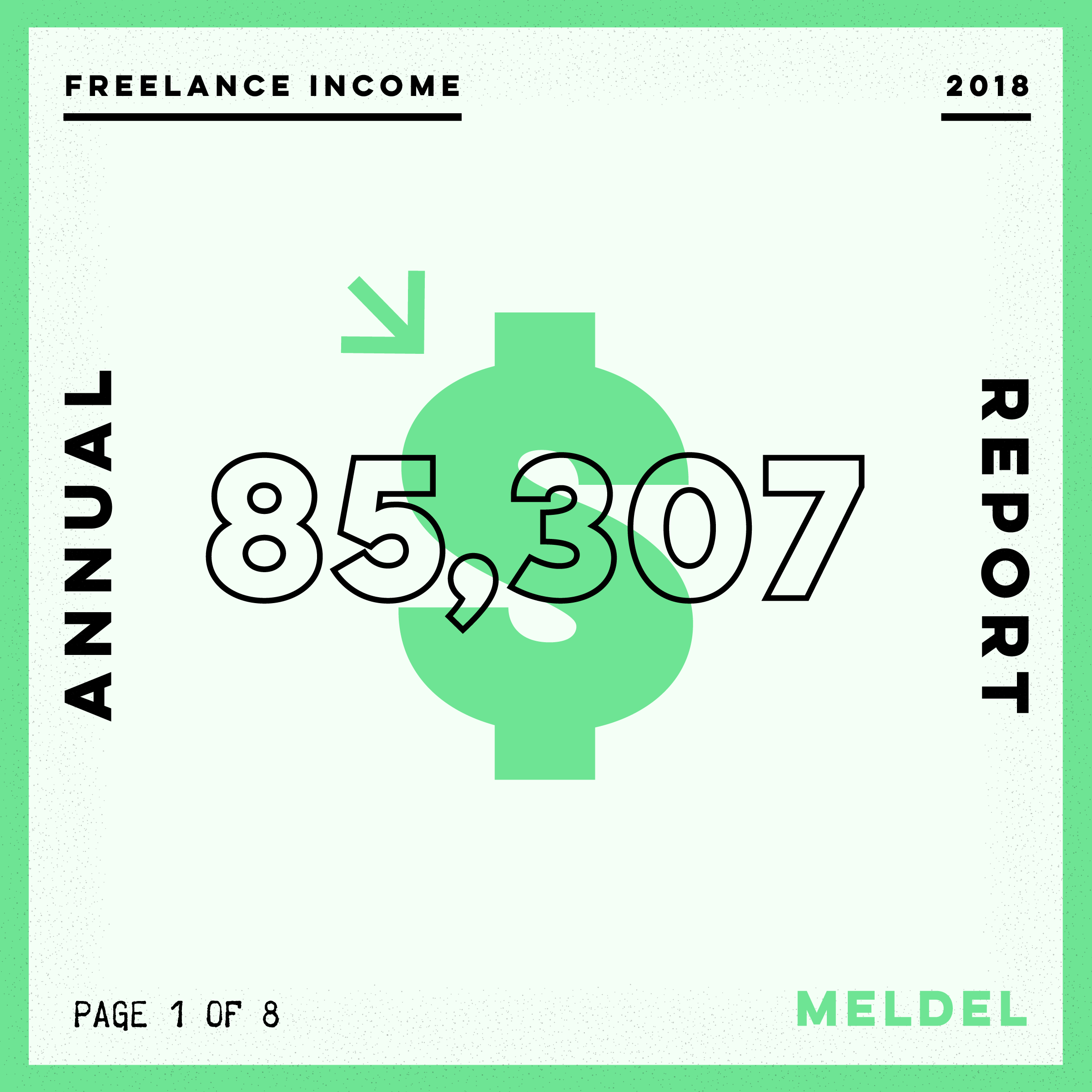

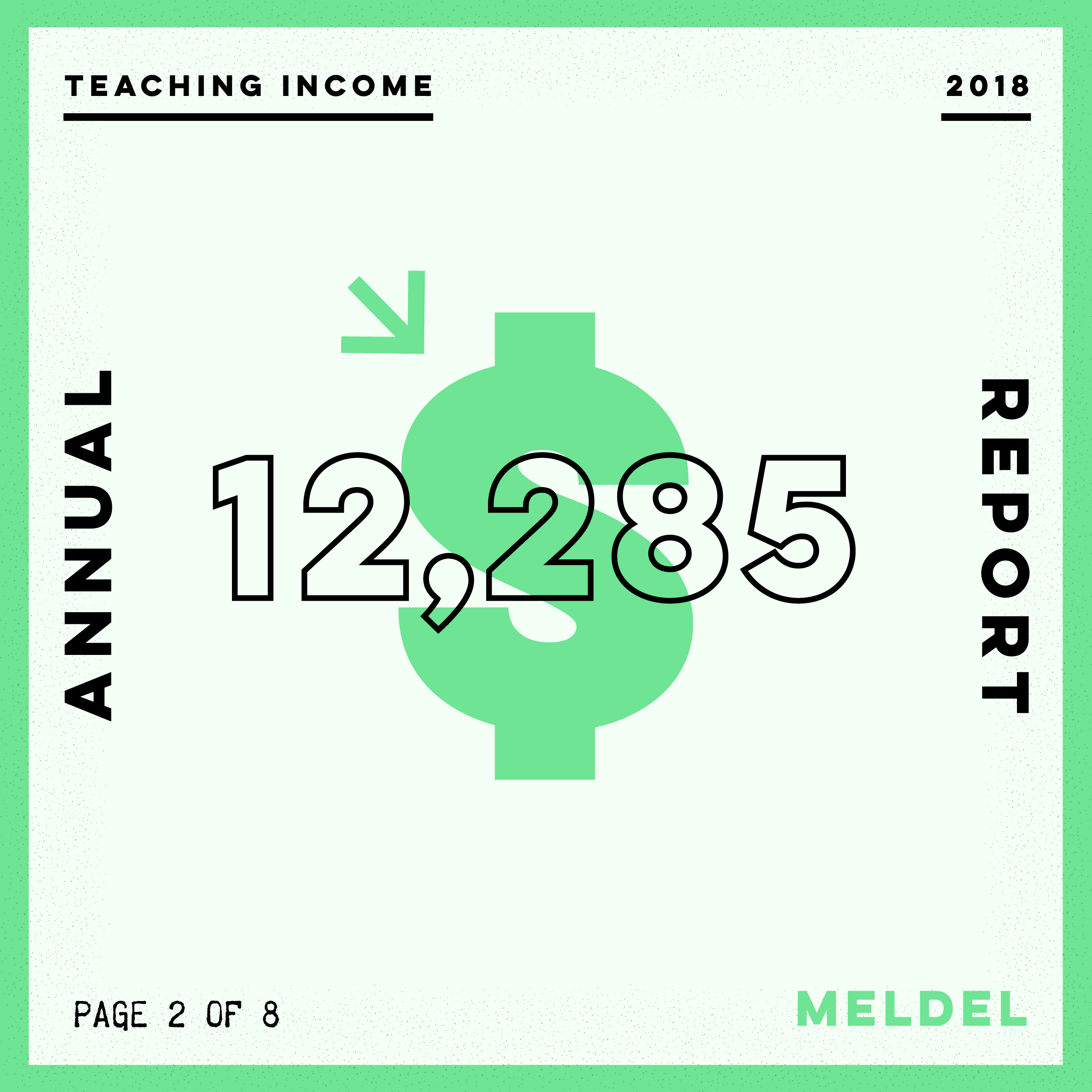

It would appear that teaching at PSU brought along a nice income bump. This year I taught Page Design Layout (twice) and The History of Modern Design. But teaching three classes (over 110 students) while also freelancing was untenable for me, financially. Those months I taught, my freelance income dipped because I was spending about 10 - 30 hours a week on teaching, averaging 420 hours teaching for the year. These hours represent the time it takes to teach from curriculum I had already developed. If I were teaching a class for the first time, it would be nearly double that amount of hours. My freelance hourly rate is $100 per hour. My hourly rate while teaching works out to about $29 per hour, meaning I had to put in more than 3x the amount of time to equal the amount I make freelancing.

While “teaching income” looks like a nice chunk of my income picture, it was difficult for me to balance my finances during the months I was teaching two classes (it didn't help that it coincided with when my tax bill was due). I am teaching for many reasons other than the financial support. I like challenging myself, getting out of my comfort zone and I love introducing students to ideas and practices that really excite me. But what 2018 taught me is that I can only teach one class at a time, every other term, to keep things in balance.

Expenses

Taxes. Oof. This number represents the checks I sent to the federal, state and local government in the 2018 calendar year. It does not reflect my tax liability for 2018. Rather it is a combination of taxes paid for my 2017 returns as well as the estimated taxes I paid for 2018. If this rate seems high to you, it does to me too! As an LLC, I pay self employment tax which covers my portion of Social Security and Medicare taxes as well as the portion that is typically covered by an employer. Double oof! This tax total does not include my husband’s tax contribution and is only representative of my income tax.

Retirement

Should I just throw in the towel now and commit to the idea of a monk-like existence post 60? According to Vanguard’s Retirement Income Calculator, by the time I’m 65, I will need to earn $7,083 monthly to live comfortably, keeping up with inflation. If I continue saving at my current rate, I may have $3,105 per month available between investment income and social security, a nearly $4,000 a month gap. In order to get that darn bar graph up to $7,083 per month, I have to set aside $36,000 a year! This is so alarming! I have committed to setting aside more money, but the gap between where I'm at and where I need to be seems insurmountable. I spent some time this year commiserating with some of my lady boss friends. We named our informal gatherings "Makin' Cents Outta Money" and together we hashed out our investment struggles and shared learnings. It was immensely helpful to know that I'm not alone in this predicament. I have been working on balancing my current investment portfolio, letting go of some stock and re-investing in index funds with low expense ratios. I learned about dollar-cost averaging, and am working on setting up a monthly automatic contribution rather than a once-a-year money drop. If you are knowledgeable in this particular arena and have some ideas to share, reach out to me, we still have a lot to learn!

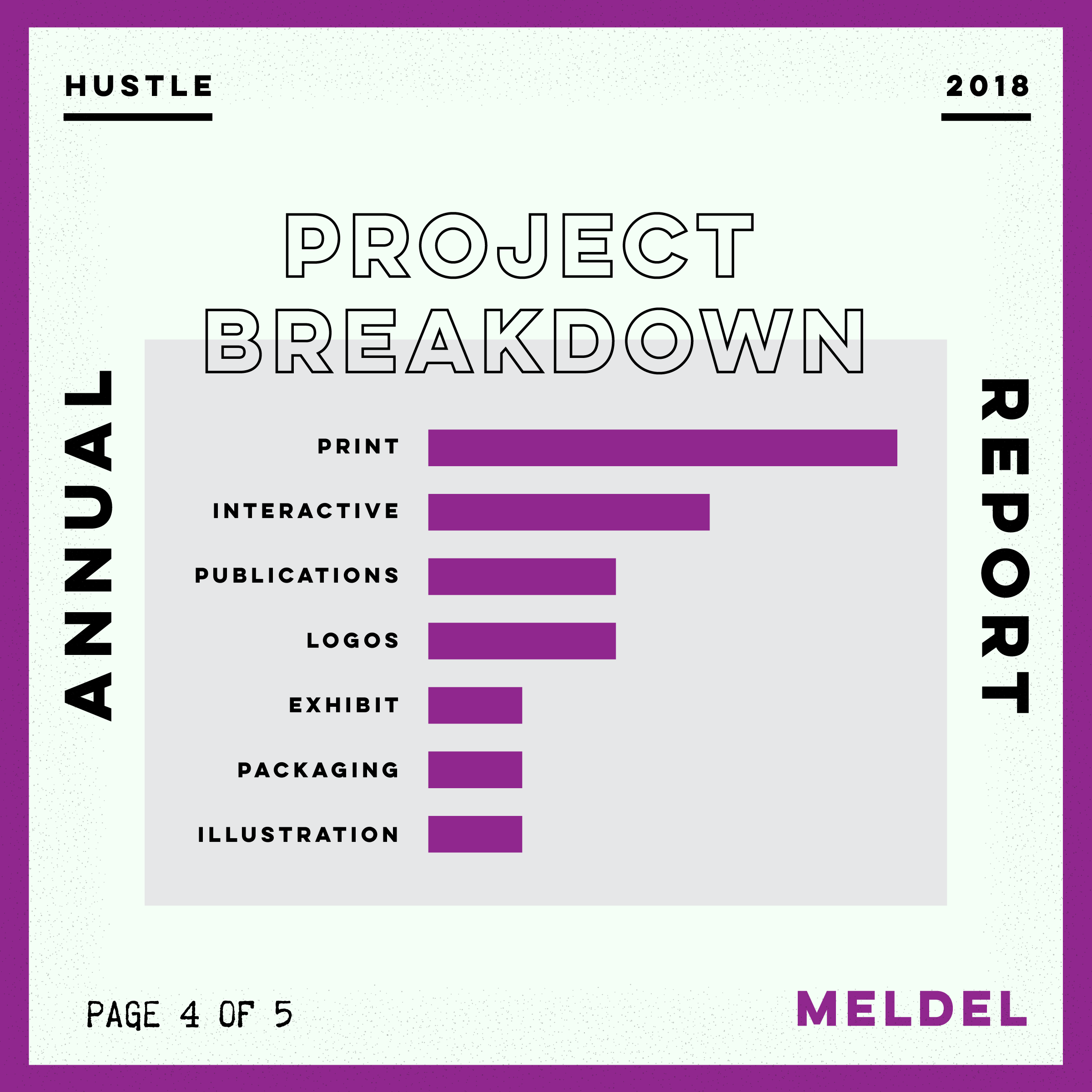

Respect the Hustle

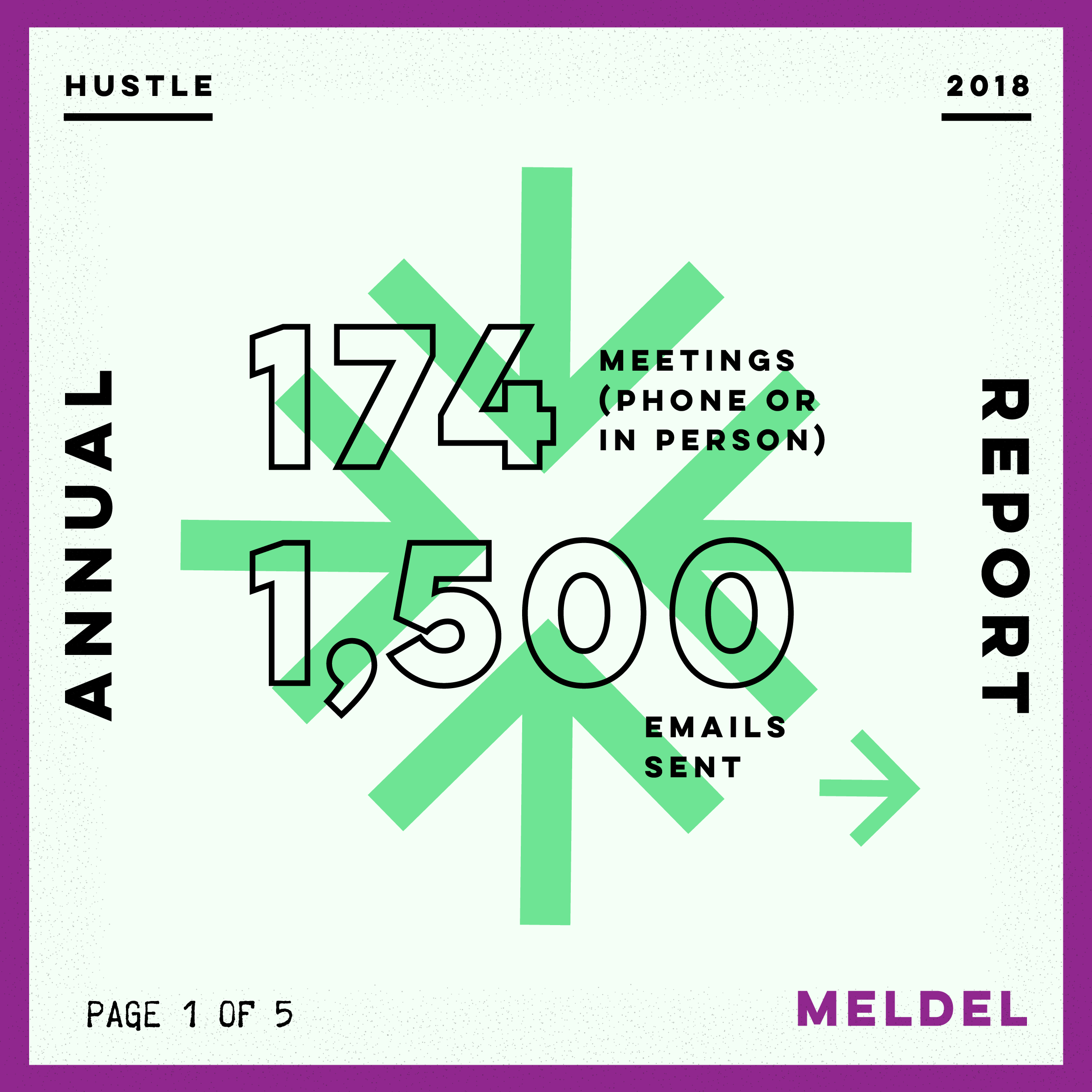

When I have friends who leave freelance to get back to agency design life, they most frequently cite the "hustle" as the reason they throw in the towel. That, and not being the type to thrive in a work-from-home environment in the era of streaming TV and social media. I get it! Agency life would feel like a vacation to me. As independents we manage our own projects, compose our own estimates, manage billing, conduct all necessary project research, do all our own marketing including social media promotion, attend way too many meetings, and manage client relations. We have to be skilled presenters, time managers, client communicators, new development managers and production artists. It's exhausting! The hustle can be hard to quantify. It can feel like stress, even when everything is going well and things are under control. There is just always a lot to juggle. Being independent means you never really turn work off. You may set it aside for the night or for a weekend when you are lucky, but there is always something to do. Any downtime means playing catch up on portfolio updates, social media sharing, email communication that you've back-burnered or working on personal projects.

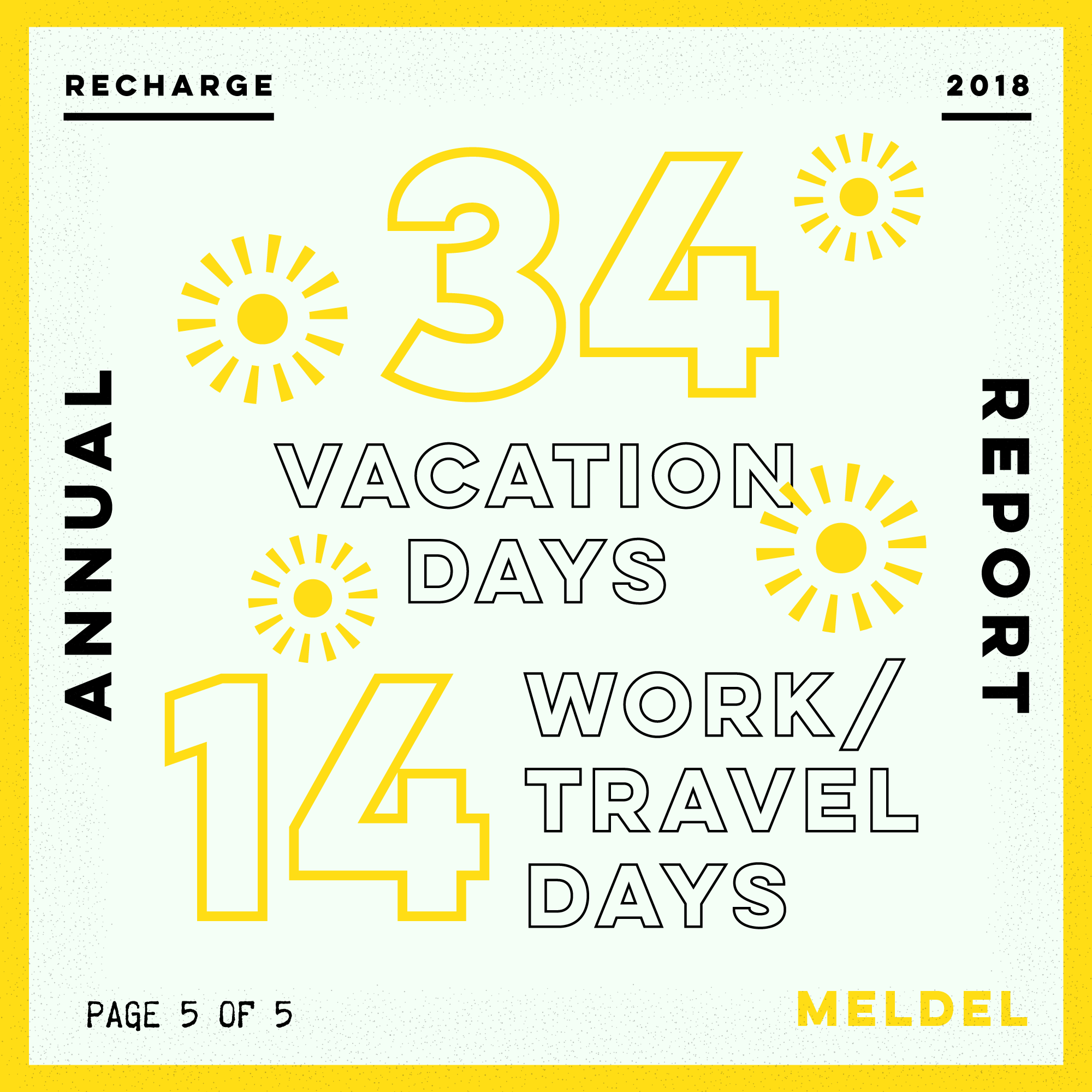

Battery Low Recharge

Travel and vacation are so vital to me (see above). Taking time away to pursue creative interests, or visit friends and family is necessary to stay sane. This is where being an independent really shines! In 2018, I was able to take 34 vacation days. I don't have to ask permission or worry about reaching a set limit, but I do have to communicate with my regular clients if I am going to be gone for a long period, and make sure all my deadlines are cleared up before I go.

Looking Back

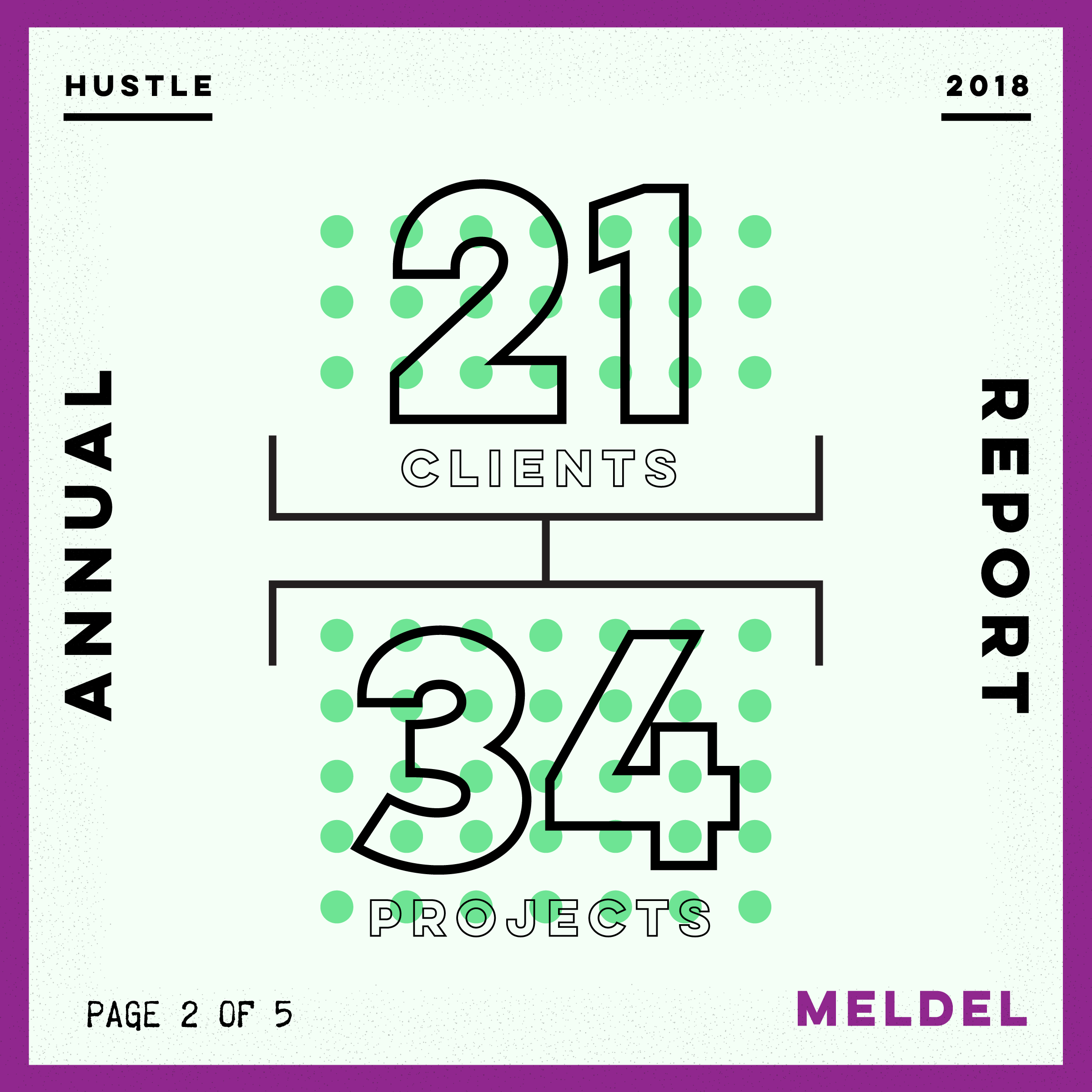

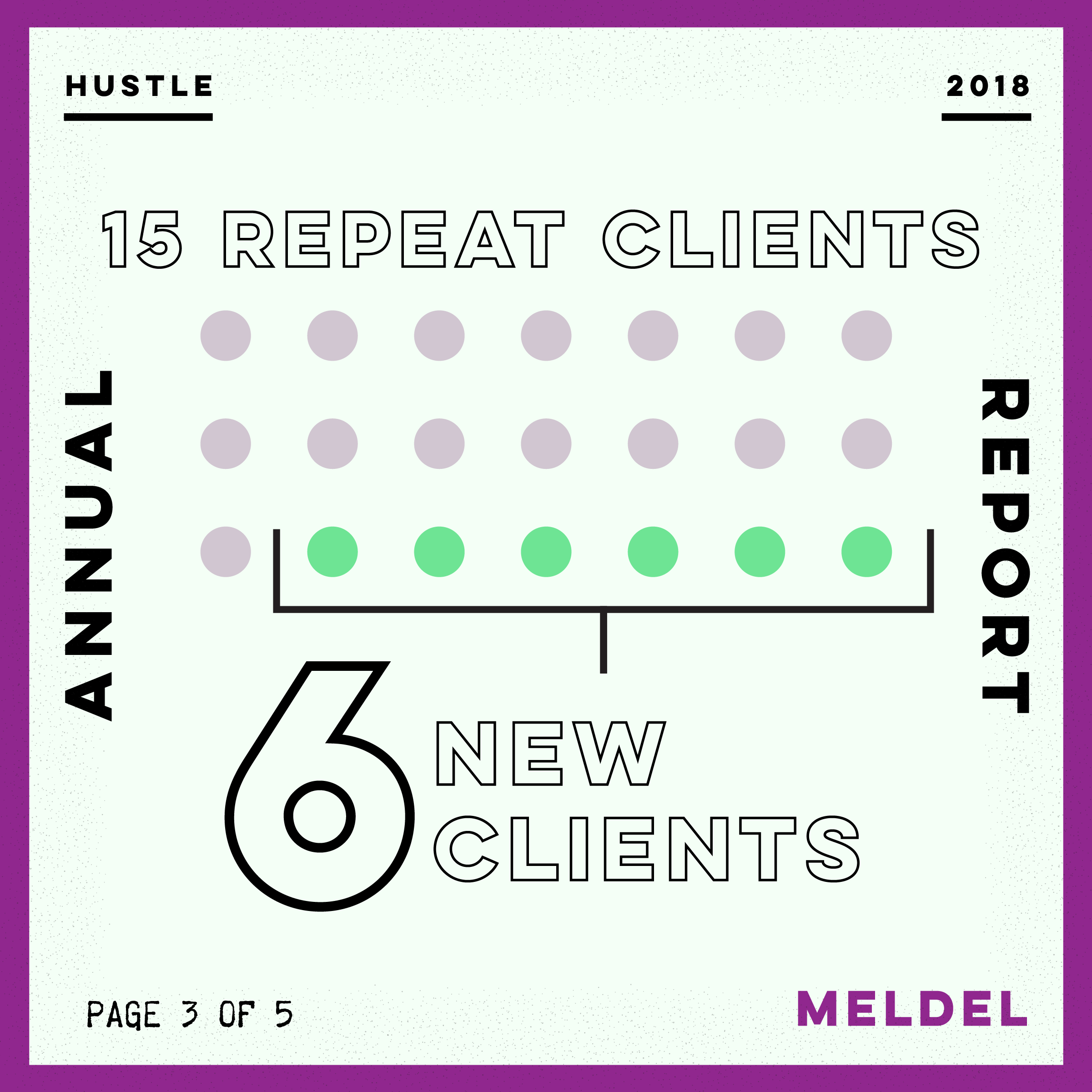

Our society has made it rather taboo to share financial successes or woes. But as an independent, I have found it so helpful to lay my cards on the table and learn from my fellow independents. It's why I raised my rates last year. For those considering going freelance, it is vital to know exactly what it means financially. My first year freelance I made $42,000, matching the salary I made at an agency, pre-recession. Now I regularly earn double that, but my salary over the last 5 years has varied between $65,000 and $95,000. That is a big variation! On average I have made $5,000-$8,000 more every year, with 2017 being the exception. The early 2017 slump could be explained by a tumultuous political scene, but it is really hard to know for sure what causes surges and lags in work. The increase in profit year after year can be attributed to filling more of my hours with billable work. Still, on average about half of my tasks are non billable. It is the work in the "hustle" category: emails, marketing, business development, estimating, project management, etc. Referrals and repeat clients account for the vast majority of my work. This is where the 9 years of building quality client relationships pays off! Earning trust and getting referrals is the nuts and bolts of consistent work.

Looking Ahead

Will I still be primarily an independent designer in 10 more years? At this moment, I have not found another viable career move that is as rewarding, flexible and profitable as where I am at now. However, I don't see a lot of examples of women in their late 40s or 50s in this role. Will there be an age at which the independent hustle will prove to be too exhausting? Will technology advance faster than my ability to adapt? I haven't figured out these answers yet, but I hope that my expertise will continue to be valued as I zoom through middle age.