About This Moment…

“We're in a giant speedup just like Charlie Chaplin in Modern Times, if you remember that old classic movie where he's working on an assembly line. It's getting really fast. But so are we. And work doesn't end. You know, we're on all the time.”

~ Sara Horowitz, Founder of the Freelancers Union on freelance anxiety (Unladylike podcast, episode 80, “How to Work the Gig Economy”)

I copied the above quote down on March 10, 2020, while COVID fear was growing, but before the shutdown brought our lives to a screeching halt. Before COVID, a reset, a rest, a societal pause was unimaginable. COVID is the Charlie Chaplin character from Modern Times, getting sucked into the gears and grinding our economy to a standstill. With the gears stopped, COVID dances, mocking the power structures in place around it.

This current, pandemic-induced slow down has caused us to be growingly impatient about oppressive systems. Systems that demand essential low-wage workers risk their lives to get the gears moving, without granting them any protections (living wage, health insurance, paid sick leave). A society that insists that Black, Indigenous and other people of color are equal, while supporting systems that enforce inequality and injustice at every measure of their livelihood: health, wealth, employment and justice. Even the comfortable, white middle class has been forced to consider what happens when their health insurance is linked to employment, and a public health crisis causes massive layoffs. What happens when all of our retirement money is invested in a volatile stock market? We must understand that the unrest in 2020, provoked by a pandemic and police violence, is set against the backdrop of extreme wealth disparity that is amplified across racial and gender lines.

In light of this renewed awareness, people are demanding fast change in these slowed times.

The Creative Gig Economy and Me

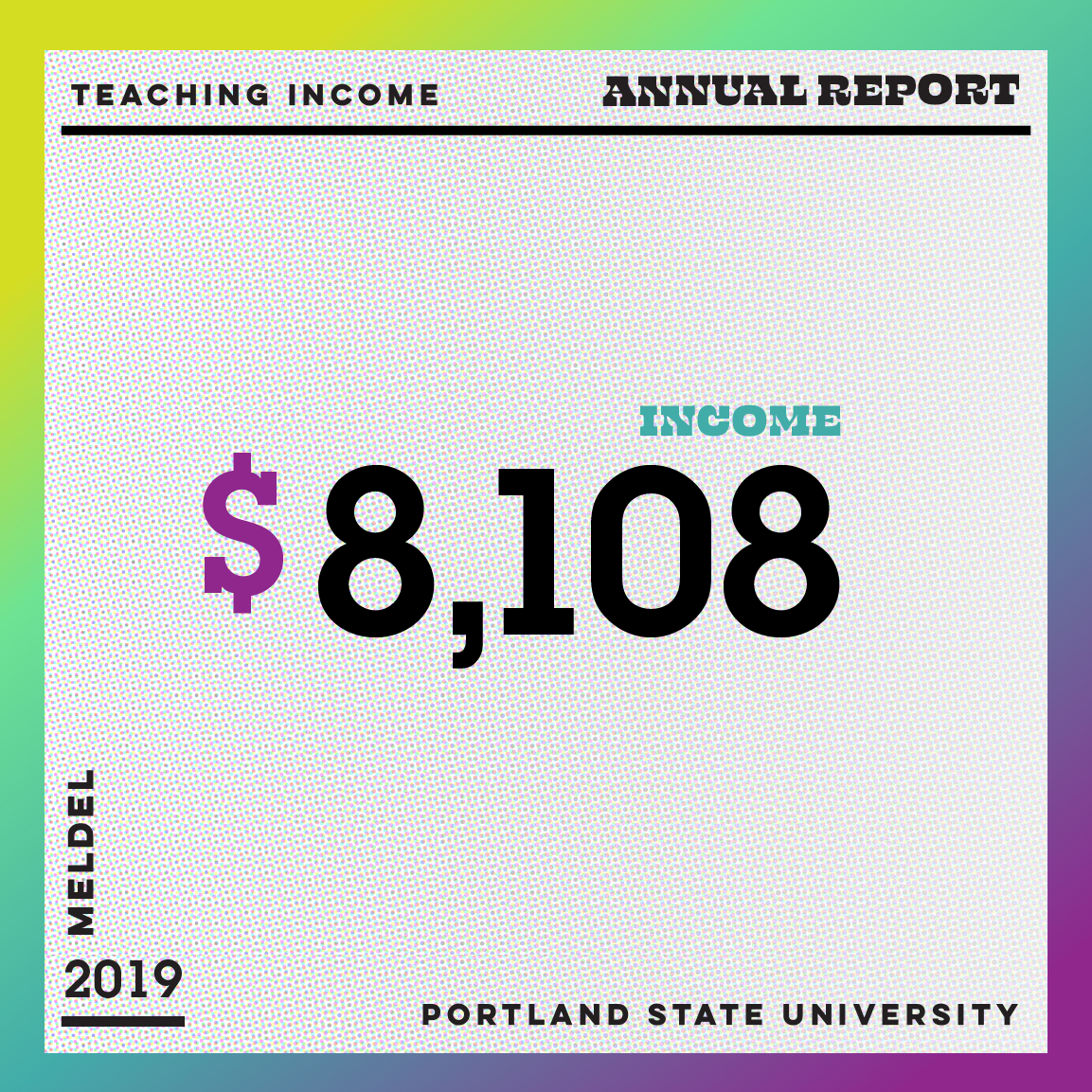

The purpose my annual report has always to dive deeper into understanding my own financial positions, and share them in hopes of helping other freelancers. In this upside-down world, freelancers may have a slight edge: we’re nimble, light on overhead. Many folks already work from home. As a designer, working from home. I can still continue my work uninterrupted. Digital design is more in demand, which I offer, and I work with a lot of nonprofits whose budgets are somewhat fixed for the year already. Another bonus is that it is now easier to solicit work from clients outside Portland because everyone is working remotely.

Creatives in general, however, are more vulnerable to economic upsets. Marketing budgets are easy to ax when a company or organization needs to cut costs. As of this writing: July 2020, my work has not been affected by COVID. But an extended economic downturn will likely affect all my clients to some capacity that may result in a decline in work for me in the future.

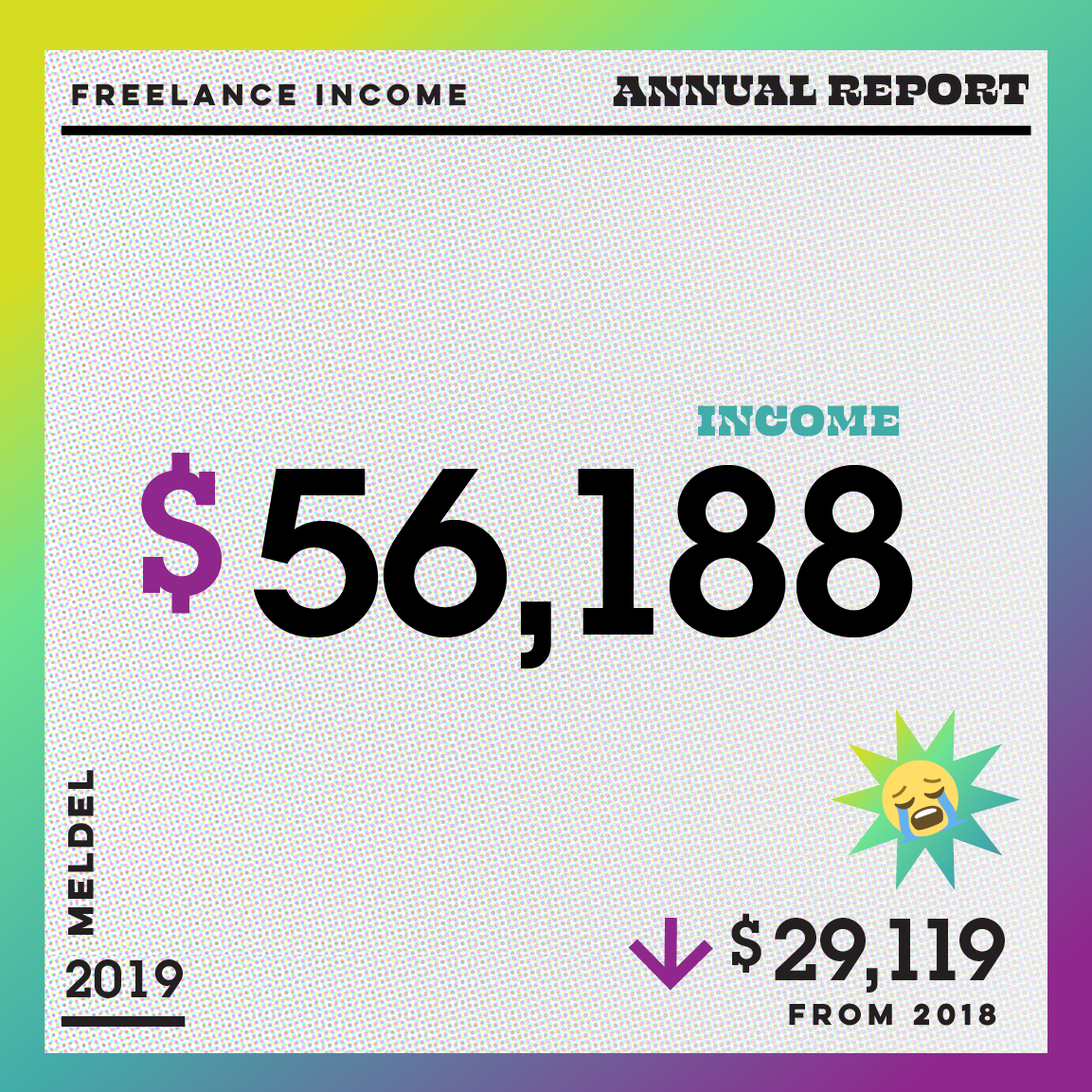

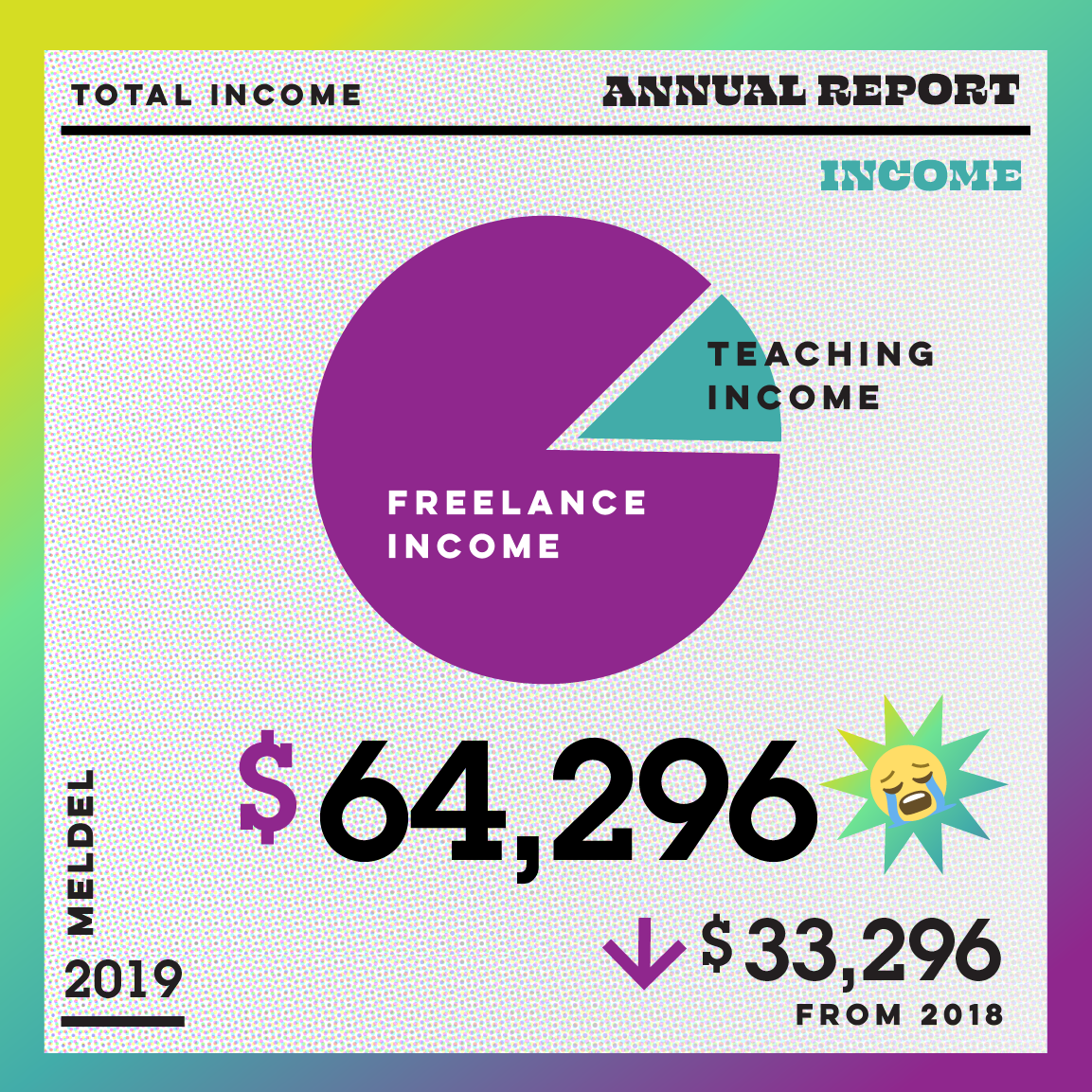

But, This Report is About 2019

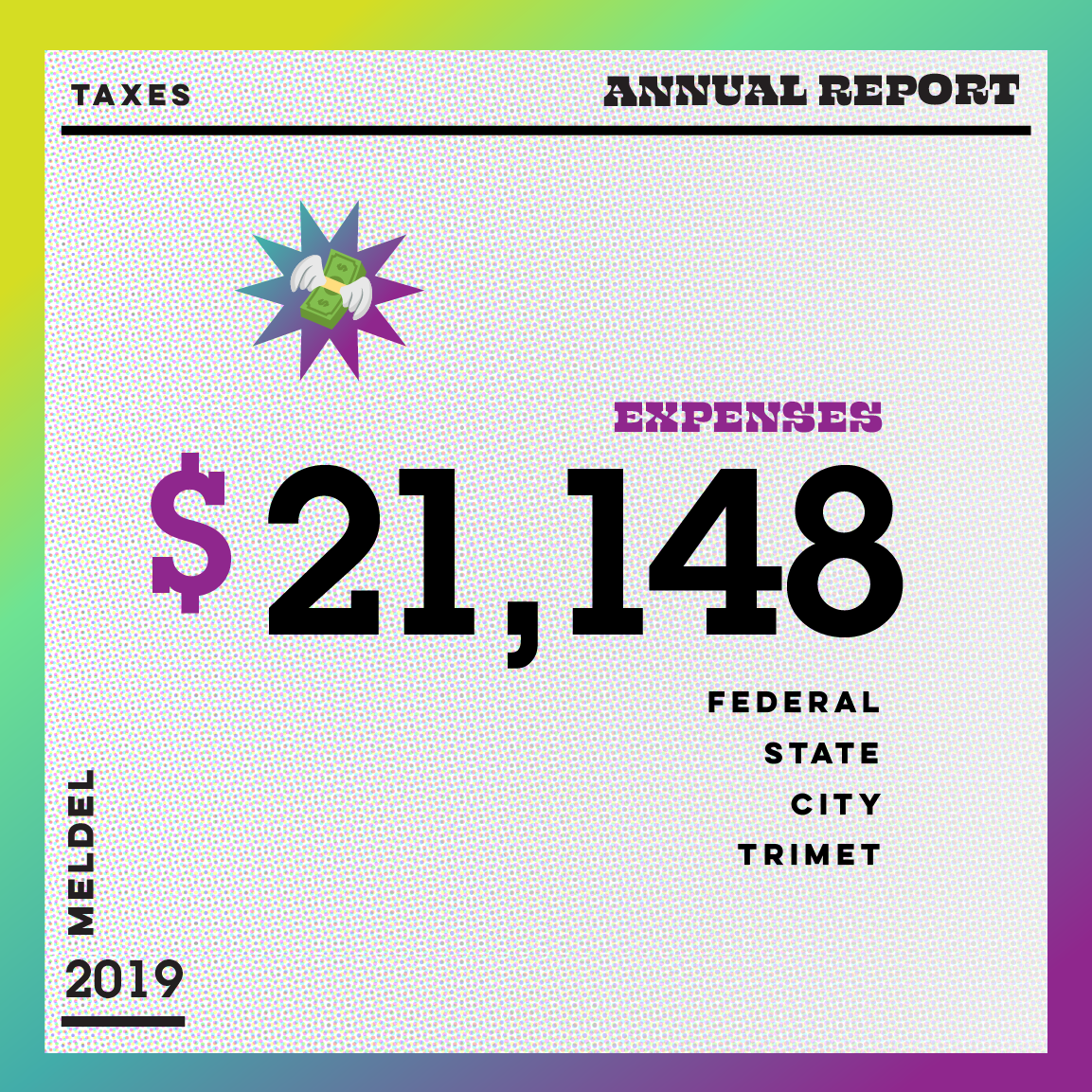

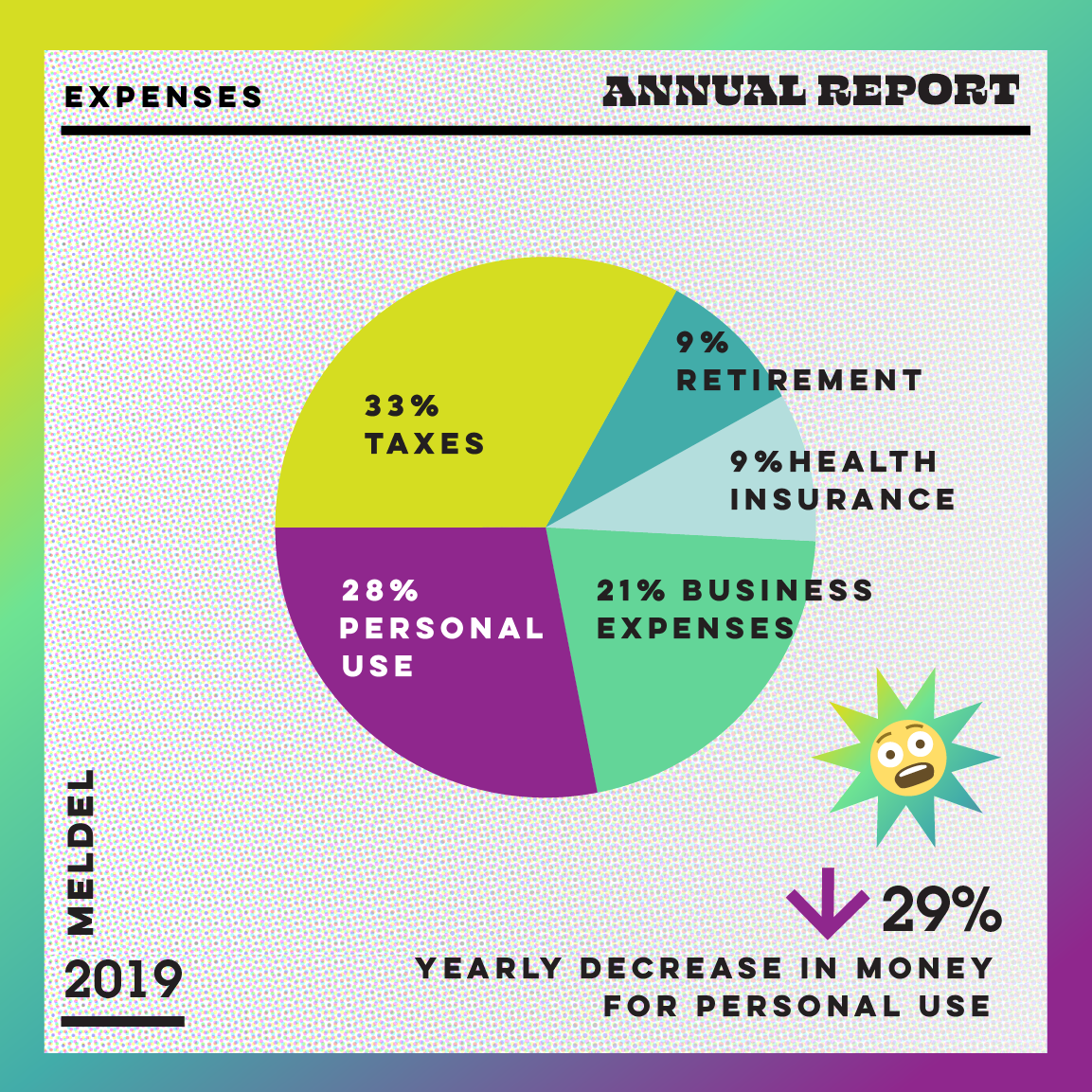

2019 was a downturn year for me, financially, despite having a banner year in 2018. A decrease in income by nearly $30,000 is so intensely difficult to shoulder, especially when taxes came due in April 2019 for 2018’s earnings. The combination of owing taxes from a previous banner year (I owed more than what I paid in estimated taxes), paired with a very low income year, set me back. It was only because of a family gift we inherited, that I was able to pay my full tax bill on time. While I was able to pay taxes*, insurance, and even contribute to my SEP IRA, I saw a 29% decrease in money for personal use. This meant personal budget cuts. I know that this is not a real hardship compared to the many workers in our economy to whom “vacation” is an abstract concept, and food basics are a stretch.

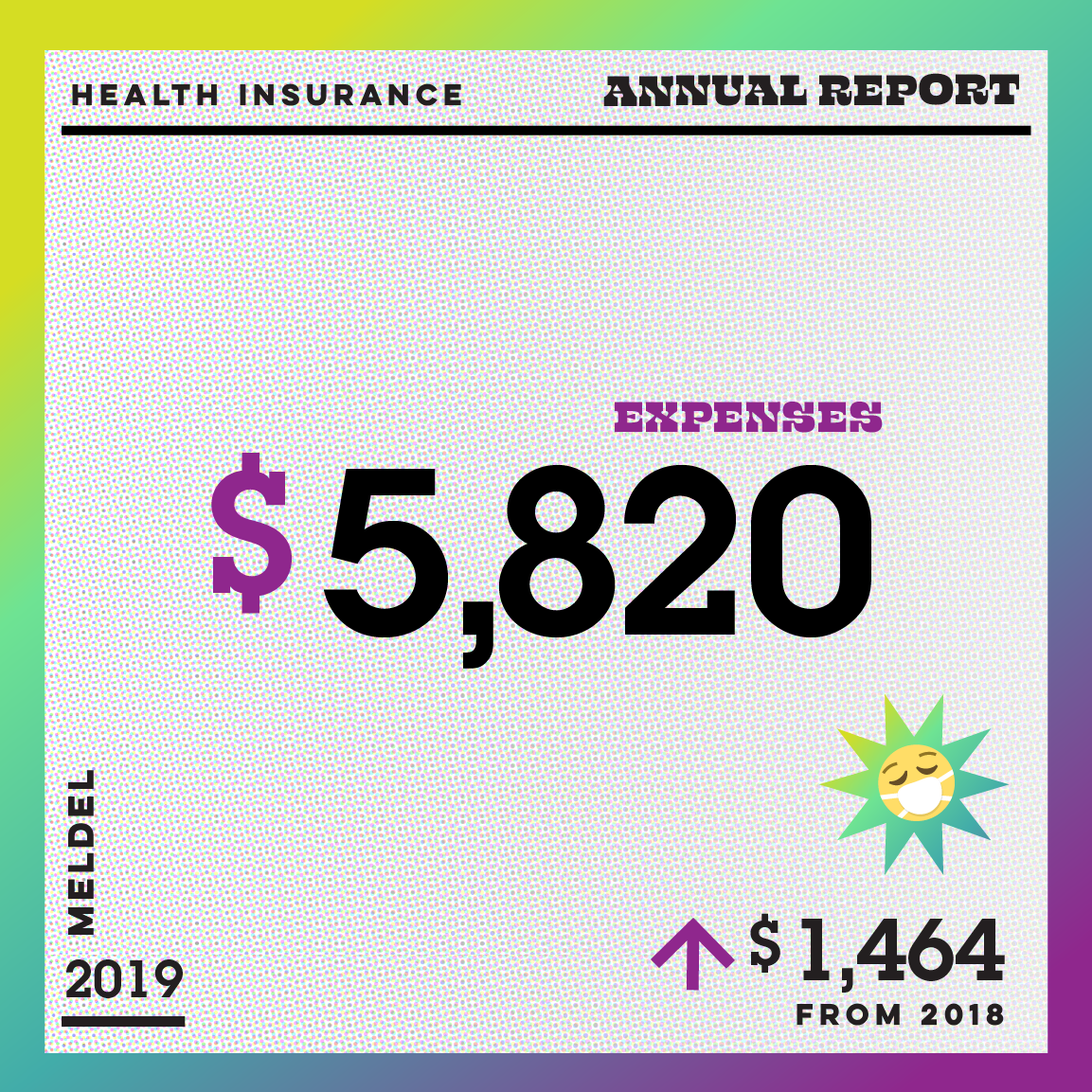

To top it off, there were many price increases for the basic necessities like health insurance. After 10 years of being a part of the independent marketplace for buying health insurance, the plans had reached a tipping point of being exceedingly costly for a product that kept getting less and less inclusive. I abandoned the independent market and hopped onto my husband’s plan. His employer offers high quality plans for spouses, but they have to pay full price. So in 2019 I paid $1,464 more in insurance, but finally had a “deluxe” plan that is more reliable for my middle-age self.

Despite still making a respectable household income, our household has yet to “get ahead.” Meaning, outside of allotting the bare minimum to retirement, our savings hasn’t grown in a decade (until 2020, strangely). But, neither has our household debt. We’re not increasing our income by a larger margin than our bills. Our economic position is in a delicate balance.

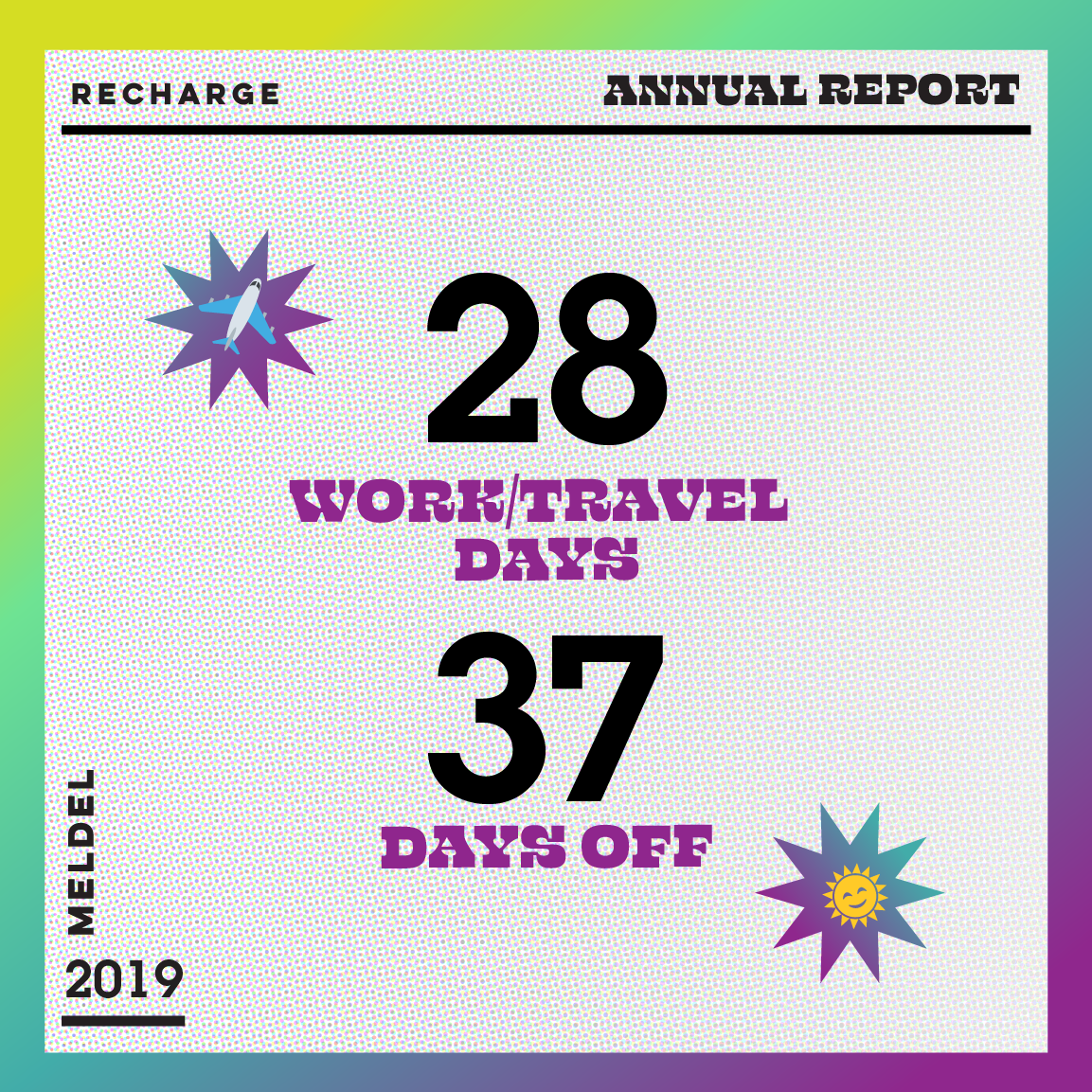

While being economically languid, I still had the good fortune and privilege of traveling on four trips that were paid for by: a client for work; Portland State University as a part of a grant; USAID as part of a volunteer assignment; and finally by the Portland Trail Blazers as my husband and I won a trip to a LA game through the “Wear in the World” contest! What a lucky gal!

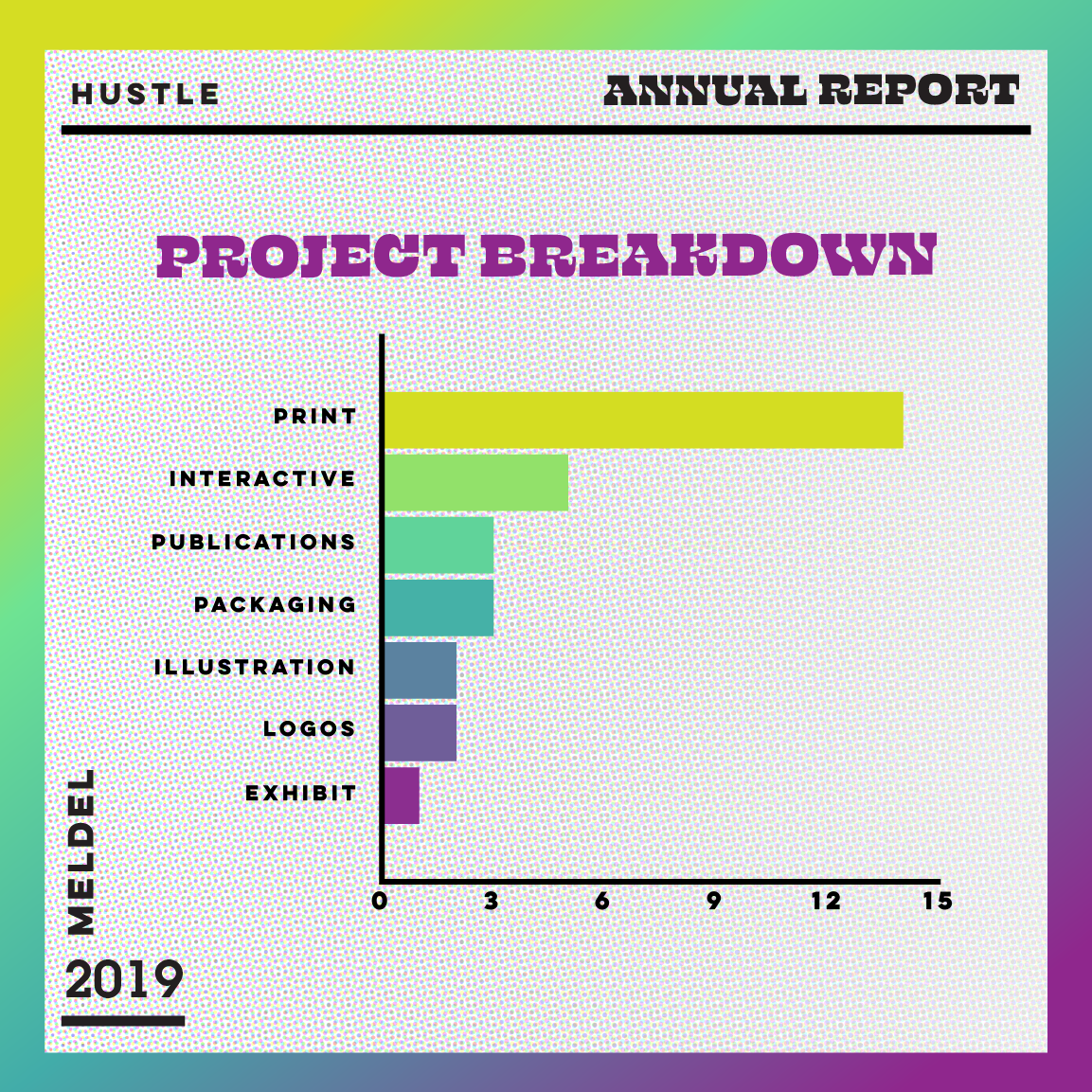

Why my 2019 income declined, is a mystery to me. 2019’s 20 clients and 30 projects isn’t that much a decrease from 2018’s 21 clients 34 projects. I even gained two more NEW clients compared to 2019. What was different obviously was the scope of work: budgets for my projects were smaller than in 2018.

This could be part of a larger economic trend. Although, there were booming stock markets and low unemployment rates in 2019, lower and middle-class Americans are not experiencing the same economic growth. According to The Oregonian, Pre-COVID, “…good economic times washing over Portland are actually making life harder. As affluent workers bid up the cost of buying or renting a home, those in low- and middle-income jobs find themselves falling behind by staying in place.” These forces may have effected my slow year, or maybe the slow year was a total anomaly, irrespective of the larger economic environment.

Either way, as of July 2020 that trend has been reversed, such is the volatile, mysterious nature of freelance.

In my graphics, I put Harriet Tubman in her rightful place on the $20 bill, replacing the white man who profited from enslaved labor and forced Native Americans from their ancestral homelands. We are living through an important moment in history, where the large, destructive machinery of the past is no longer supporting the health and wealth of most Americans. How will we all work to support change?

~Melissa

*Taxes paid means money that I spent in 2019 paying taxes (mostly covering the bill from 2018).

2021-2021 Annual Report

2018 Annual Report

2016 Annual Report